This post is part of a series sharing inspiration and actionable insights from the 2016 LeadingAge Annual Meeting, for non-profit senior living communities and service providers – “organizations dedicated to making America a better place to grow old.” Click here for previous posts.

Session: Sales and Marketing Tactics for Continuing Care at Home

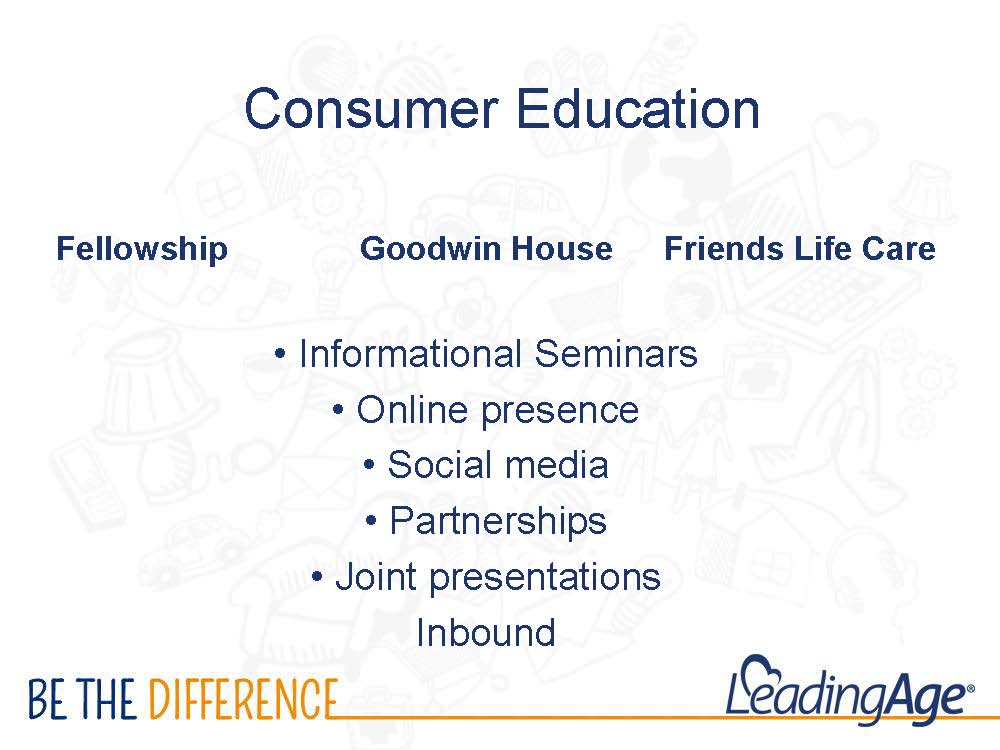

Speakers: Joan Kelly-Kincade, Friends Life Care; Karen Skeens, Goodwin House; Elizabeth Fandel, Fellowship Senior Living

“We’re not managing a long-term care policy, we’re helping people plan. It’s not about what is the matter, it’s about what matters most.”

This is how Liz Fandel of Fellowship Senior Living at Home (a Creating Results client), explained the unique selling proposition of Continuing Care at Home (CCAH).

CCAH programs offer care coordination, care-giving and asset preservation to older adults who do not want to live on a retirement community campus. With CCAH, they can remain in their own home as they age.

There are just 29 CCAH programs across the United States. The first model launched in 1990; 27 programs were added between 1998 – 2015. (Fellowship’s program launched in 2011 and another Creating Results client, North Hill, introduced a CCAH offering this year.)

One key to the successes across all of providers that spoke in this session was – EDUCATION.

Karen Skeens of Goodwin House at Home shared the mix of educational efforts their organization employs.

MARKETING ACTION STEPS:

Since it’s a relatively new concept, we must help our prospects understand the benefits and the financial value of enrolling in a CCAH program early. The sooner you become a member, the better you are long-term.

When marketing Continuing Care at Home, tout the tax benefits, especially at the end of the year when prospects will be thinking about and getting their taxes ready.

CCAH programs not only protect assets from the financial risk of medical costs, the fees can be deducted as a medical expense from federal income taxes.