A new week, a new round-up of the content that grabbed the attention of marketing pros!

Each Monday, we tally which were the boomers / seniors marketing articles, research and other items that got our followers engaging on Twitter, Facebook, LinkedIn and Ghost-Town Plus … er, I mean Google Plus.

Then, we share the top items here on our blog. Be sure to follow us on those social platforms for even more 50+ marketing insights!

MOST CLICKED

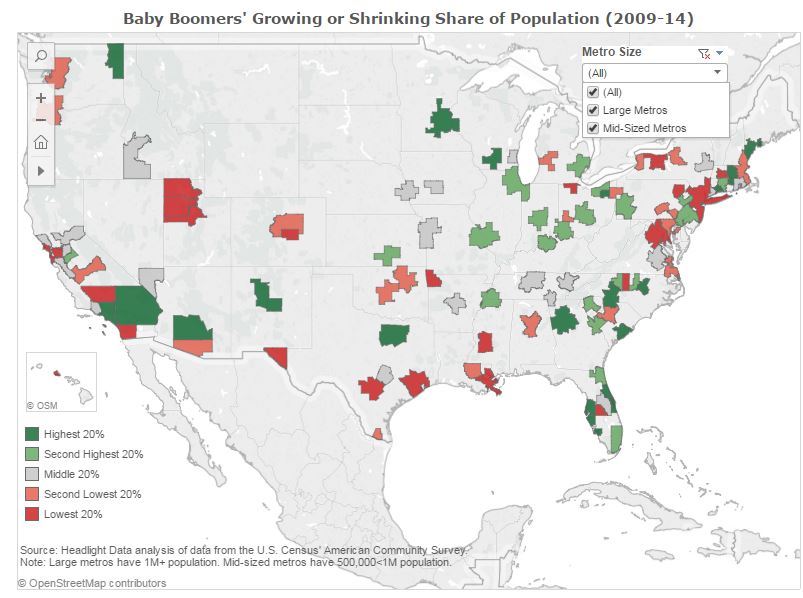

Where are Baby Boomers moving to? Which metro areas are they leaving behind?

Headlight Data analyzed the most recent U.S. Census Bureau American Community Survey for an actionable summary of trends:

Fastest-Growing Boomer Cities

Per Headlight Data,

“From 2009 to 2014, baby boomers’ share of the U.S. population increased by 2.3 percentage points. The mid-sized metros with the greatest 5-year increase in the percentage of baby boomers are Palm Bay-FL (+4.4 pts.), Deltona-FL (+4.0 pts.) and North Port (+3.1). Albuquerque-NM, Worcester-MA and Portland-ME also increased by more than 3 percentage points …

The large metros with the greatest 5-year increase in the percentage of baby boomers are Phoenix (+3.3 pts.), Charlotte (+3.2 pts.) and Dallas (+3.0). Raleigh and Tampa also increased at least 3 percentage points.”

Mid-Sized Cities

- Where the Boomers are: North Port, Florida (30.4% of the population vs. the national average of 24.5%); Palm Bay, Fla. (30.3%); Deltona, Fla. (30.0%); and Portland, Maine (29.1%).

- Where the Boomers aren’t: Provo, Utah (13.1% of the population); McAllen, Texas (16.5%); Ogden, Utah (19.0%); and Bakersfield, California (19.2%).

Large Metros

- Where the Boomers are: Pittsburgh, Pennsylvania (28.3%); Cleveland, Ohio (27.1%); Buffalo, New York (26.9%); and Hartford, Connecticut (26.6%).

- Where the Boomers aren’t: Salt Lake City, Utah (18.9%); Austin, Texas (20.0%); and Houston, Texas (21.3%).

Headlight has several nifty interactive maps that illustrate the growing or shrinking share of the population among those aged 50 to 69 years old. Click on the image below to be able to focus on either large or mid-sized cities, and for additional data visualizations:

Be sure to follow the “RELATED” links below for more thoughts on Boomers and urban living.

MOST SHARED

A trio of items about retirement got people reading and tweeting last week.

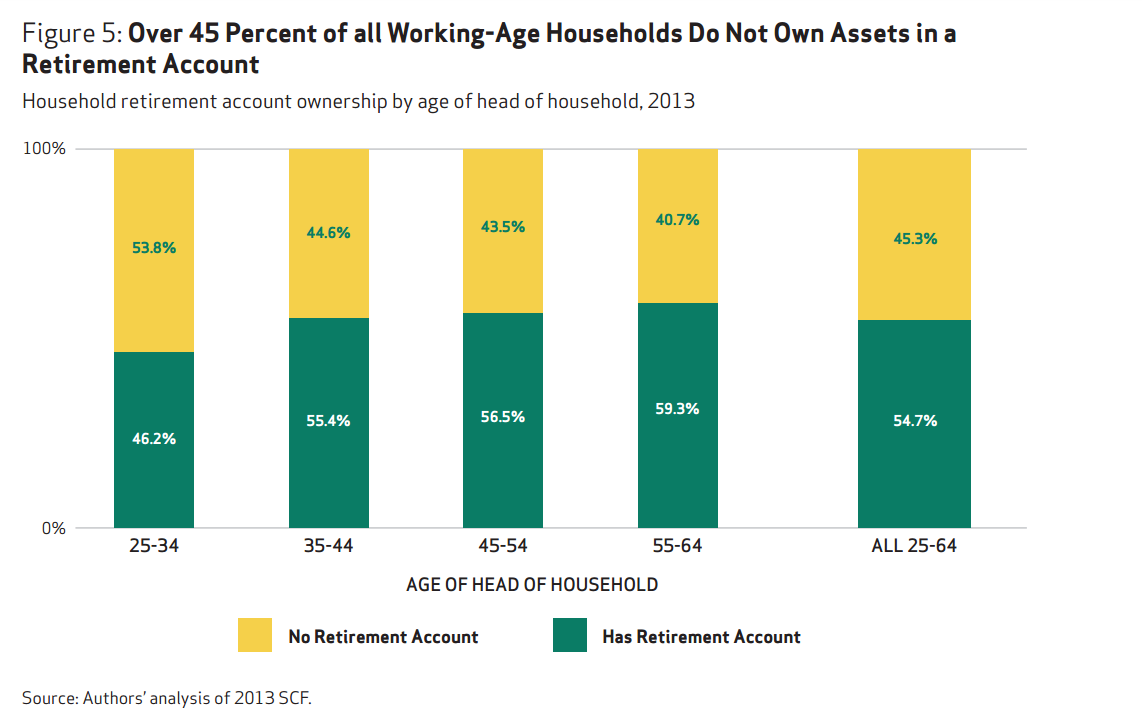

First, troubling news via TransAmerica’s New Age of Advice: What is the average Joe saving for retirement?

“It may be close to nothing.”

TransAmerica quotes a study from the National Institute on Retirement Security showing the average working-age household in the U.S. has “virtually no retirement savings.”

Source: National Institute on Retirement Security

This is just one reason why “working-age” now defines many people older than 65.

Next, Oregon State University researchers have found that if you work even one year past the typical retirement age of 65, you increase your chances of living longer.

NPR’s Patti Neighmond reported on the study, quoting psychologist Robert Stawski and researcher Maddy Dychtwald:

“Even those who said they were unhealthy were also likely to live longer if they kept working. And that was in any type of job – white-collar, blue-collar or in the service industry. Stawski says it’s likely the various interactions that are a part of work are key.

STAWSKI: Thinking, problem solving, cognitive faculties, social and interpersonal engagement – so you have relationships that you’ve formed with co-workers, both personally and professionally.

DYCHTWALD: It’s almost as if work and retirement can be a kind of antidote to aging.”

Not to play the “we said it first game,” but all this talk of retirement and an extended worklife reminded us of a 2012 Mature Marketing Matters post.

Not to play the “we said it first game,” but all this talk of retirement and an extended worklife reminded us of a 2012 Mature Marketing Matters post.

Last week’s link to that post, “Re-Thinking Retirement — 6 Lessons for Marketers” received several shares.

Those six lessons included:

1) Work during retirement years provides a paycheck …. and much more.

What besides money would people miss if they retired? “It may be cliche, but it’s family.” Connections are strong and critical to enjoying retirement years. If you’re marketing a club or physical community, illustrate the benefits of becoming a part of that “family.”

6) The lifestage called “retirement” can use some re-thinking.

Retirement cards feature pictures of fishing or illustrations of vanishing to do lists. When the reality is that people will have 30 years of “retirement,” is fishing and nothingness what they really want to do?

Make sure your marketing campaigns do not use outdated imagery to depict retirement living. Not every retiree wants to work in retirement. Marketers must illustrate the many, varied opportunities available in retirement. Your marketing must appeal to segments of one, each re-thinking and re-defining retirement for themselves.

Read the original post: http://bit.ly/1Yvxkf5

ALSO OF NOTE

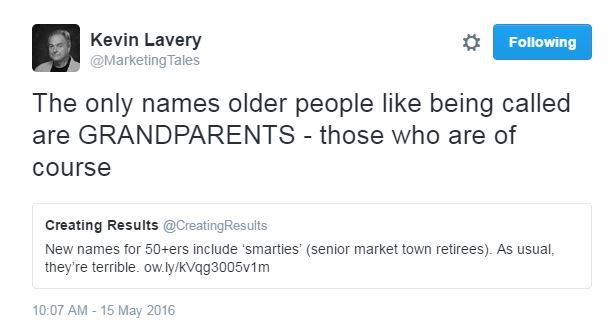

We tweeted “New names for 50+ers include ‘smarties’ (senior market town retirees). As usual, they’re terrible.”

UK mature marketing expert Kevin Lavery added his two cents:

Read about Experian’s newest nomenclature here: http://bit.ly/23UQEUr

Check out the RELATED items below for more on the name game.

And, finally, a Millennial & a Baby Boomer discuss aspects of life that help define their generation: http://indy.st/1ZXy0Ku.

Have a comment or question? Please use the tools below to share your thoughts. Happy Monday!