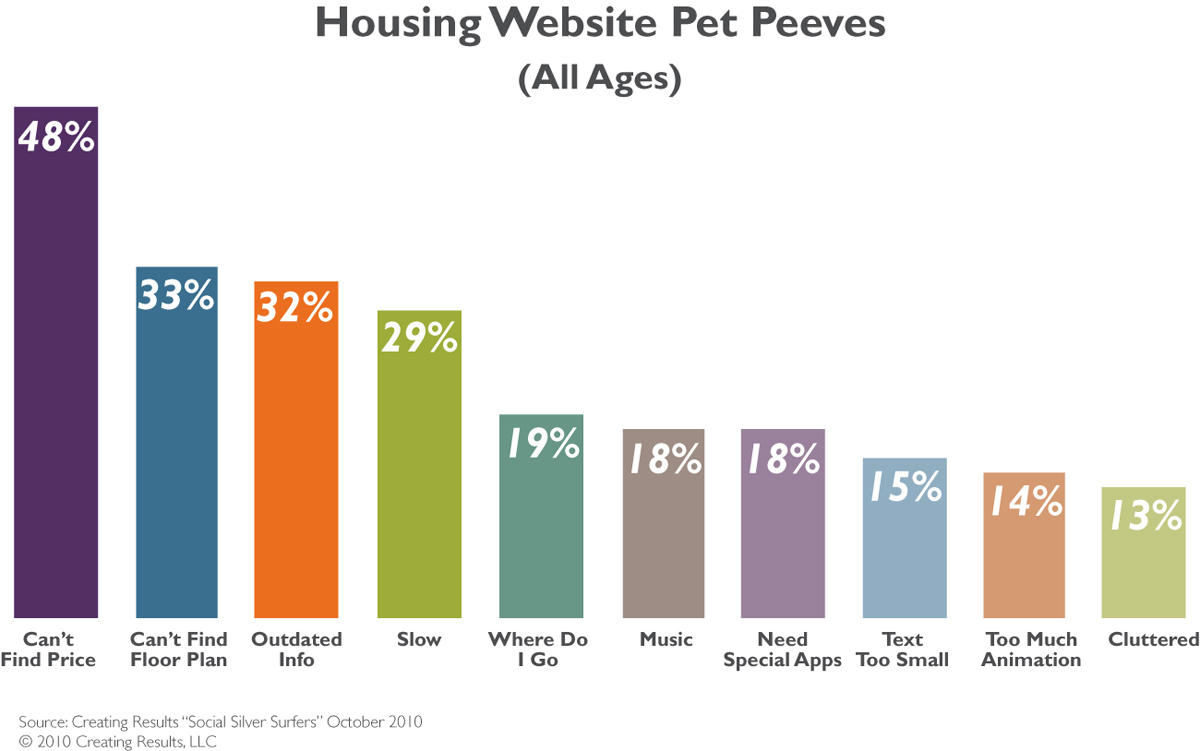

Way back in 2010 Creating Results asked recent, mature movers what frustrated them about housing websites.

#1 with a bullet?

“Don’t say price.”

We asked the question of hundreds of Social, Silver Surfers because we wanted data to back up our recommendations to senior living providers. Our team kept saying “you need to talk online about your pricing” and their teams kept saying “no!”

Now that recommendation carries even more weight, thanks to the team at Lead InSite.

Lead InSite recently published a white paper which analyzed the online behavior of visitors to senior housing websites. In this study they reveal that financial information is one of the most-visited / most-researched sections of a community’s website, second only to the section that includes floor plans and housing options.

As co-founder April LaMon told Senior Housing News, “Senior living communities should take a good hard look at providing more transparency about the financial aspects of the decision.”

Why? Because those communities that did add financial information to their website boosted by 35% the engagement with web visitors who eventually became leads.

The Prospective Residents’ Perspective

Professionals marketing continuing care retirement communities or other senior housing options have long known that the decision to “purchase” a residence in a senior community is a very unique one. Complex and lengthy.

Per the white paper,

“As they journey from inexperienced and uneducated consumers to qualified leads to new residents in senior living communities … Financial information, such as pricing, is one of the most important content areas that visitors use to pre-qualify themselves.

It is essential to understand this journey, and where each visitor is within it, in order to provide the right information at the right time to help each visitor pre-qualify themselves prior to converting into a leadbase.”

And yet, until recently, financial information was woefully missing.

Here’s how it looked in 2010:

Those aged 65-74, prime prospects for senior communities, were even more annoyed.55% of those surveyed within that age range complained about lack of financial information.

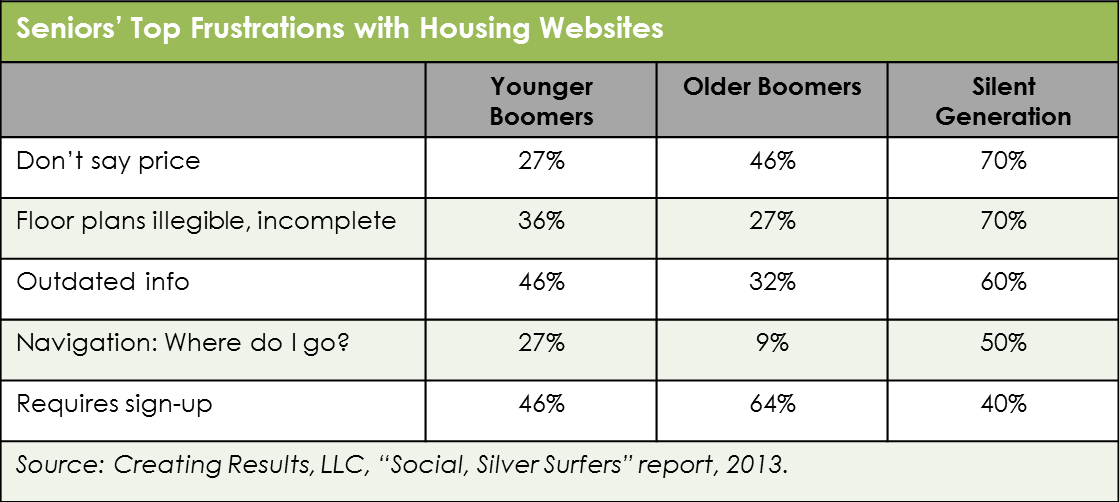

Creating Results asked the same question during our 2013 Social, Silver Surfers research: “what are your biggest pet peeves about typical housing websites?” Comparing the 2010 study to the 2013, required sign-up, missing contact information, that where-do-I-go confusion over poor navigation all took higher spots in the irritation list among all ages.

Still 46% of all respondents and a whopping 70% of Silent Generation members — again, the prime prospects for senior communities — complained about missing pricing.

The Sales Teams’ Fears

Why wouldn’t a CCRC or independent living community want the price listed on their website?

Just as the customer’s journey to a senior community is complex, so is the pricing.

Lifecare plans, size of residence, upgrades, meal plans, assets … All of these variables can lead to some tricky math. Many sales teams fear qualified prospects will be confused and decide they can’t afford something that actually is within their means.

Also sales teams often are so focused on getting phone calls coming in that they don’t want to reveal anything! “I’d rather they just call,” “That’s best discussed in person” and “Let’s force them to call” are common objections we’ve heard over the years.

The Possible Pay-Off

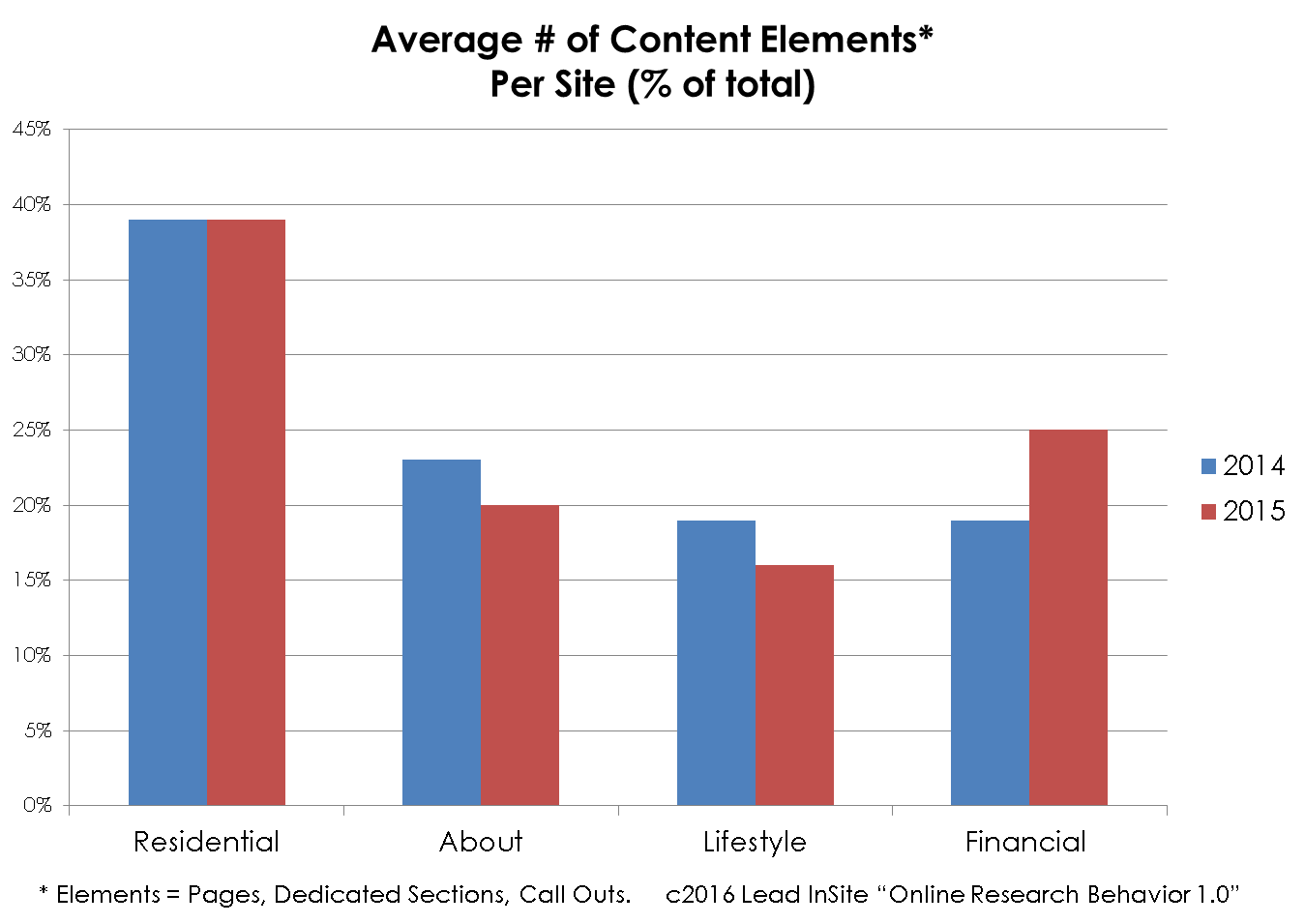

Whether as a response to the marketing teams’ demands or a growing comfort among sales teams, Lead InSite noted that there has been an increased focus on and development of web content for financial and pricing information. “In 2015 the financial sections grew more than any other section to represent 25% of content on the sites (from 19% in 2015).”

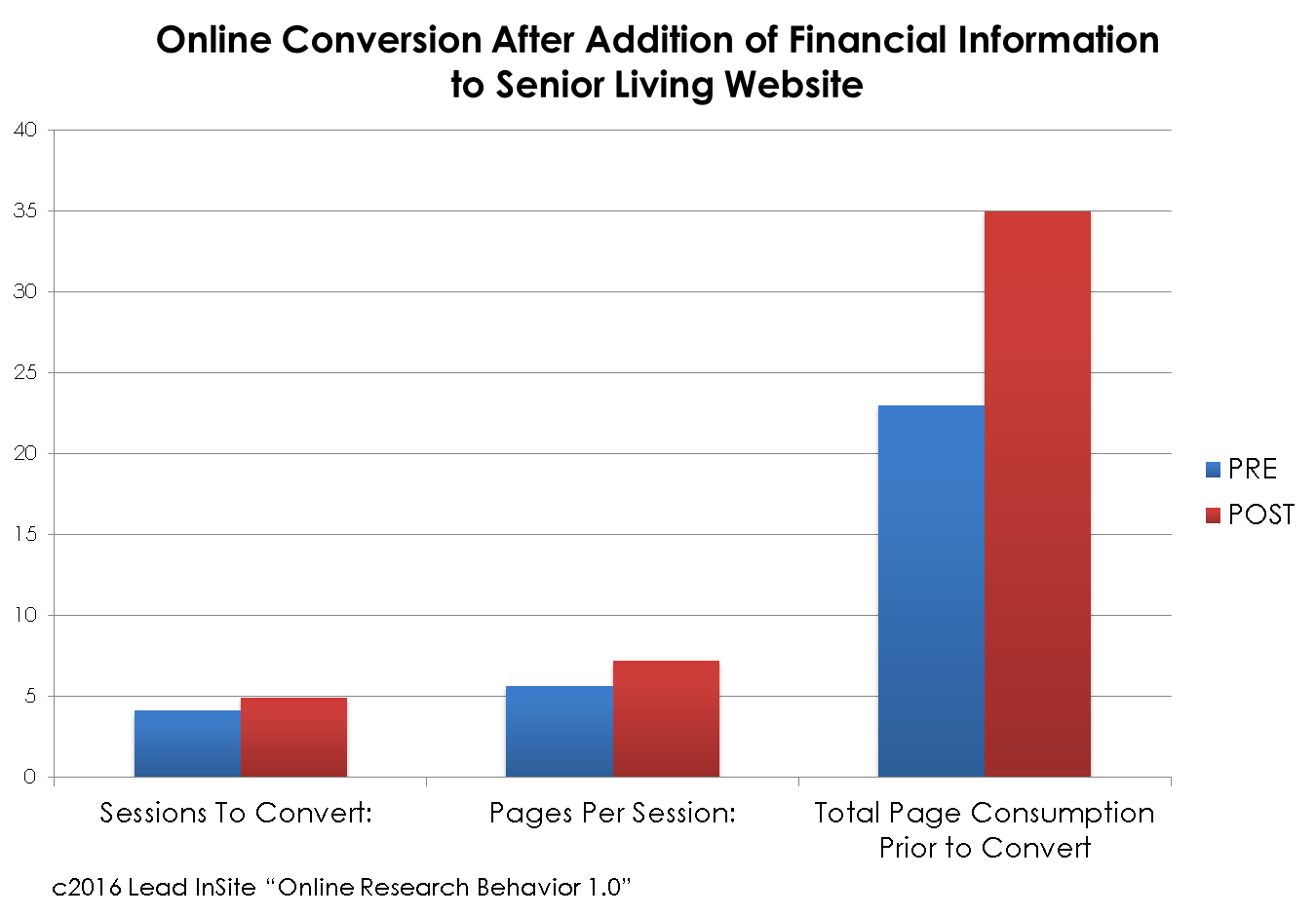

The pay-off for adding this financial content was quickly felt.

Per the report, “the websites that added financial information saw a 35% increase in engagement (as measured by total number of pages viewed or content “consumed” over all sessions) on their sites by those who eventually converted into their leadbases.”

Which means that added financial content was extremely influential in motivating lead capture, which is a necessary step towards a purchase decision.

As the white paper notes, this then speeds them towards a sale:

“Our analysis indicates that once a visitor has researched financial information and that information is consistent with their requirements they convert. Then, as they complete their purchase, their focus shifts to other areas such as residential and lifestyle requirements.

This also means that the sales team can focus on selling, not pre-qualifying, with value added information, not pricing.”

Better qualified and more engaged prospects … Why wouldn’t a senior living community continue to keep off its website? The research shows it’s desired and motivating. Please share your thoughts on “why not” in the comments below.

The Lead InSite white paper is based on the online behavior of more than 2.5 million individuals on more than 1,700 senior living community websites.Download it at http://leadinsite.co/senior-living-industry-research-paper/.