Ah, Monday. Here you are again.

While many dread Mondays, the Creating Results team has an appreciation for them. Why? They’re the days that we round-up the top 50+ marketing tweets/posts/links of the previous week.

It’s fun trying to connect the dots between engaging content and action items our readers could take! Or, at the very least, it makes Mondays a little more bearable.

MOST CLICKED (and a must-read): Leaders in Aging Send a Message to the President

The winter edition of Generations, the Journal of the American Society on Aging, features the public policy recommendations of more than 20 leaders of organizations dedicated to advancing and protecting America’s older adults. In it you’ll find sections penned by representatives of the Bipartisan Policy Center, AARP, LeadingAge, Encore, Long Term Care Partners and the National Center on Elder Abuse, among others.

The winter edition of Generations, the Journal of the American Society on Aging, features the public policy recommendations of more than 20 leaders of organizations dedicated to advancing and protecting America’s older adults. In it you’ll find sections penned by representatives of the Bipartisan Policy Center, AARP, LeadingAge, Encore, Long Term Care Partners and the National Center on Elder Abuse, among others.

Together, these articles put forth a positive vision for aging in America — if the new administration takes an active, proactive role.

As guest editor G. Lawrence Atkins writes in his introduction,

“[W]e propose a policy agenda for the most important unmentioned domestic policy issue during the recent campaign – the challenge and opportunity created by the aging of the U.S. population.”

Nearly every author mentions retirement in their piece — the inadequacy of average retirement savings, the impact on healthcare spending, the consequences for economic growth, the incredible benefits to individuals and the nation of keeping Baby Boomers working even a few years more.

Here are a few items that jumped out at us:

- Boomers may be re-defining retirement but they aren’t delaying it. Three-quarters of Americans begin receiving Social Security benefits before their full retirement age.

- The current average retirement age for men is 64.

- Low- and moderate-income households find it harder to save for retirement and harder to work longer. These workers also tend to be in worse health.

- One-half of today’s working households will fall short on income in retirement.

- “In 2013, the typical working household approaching retirement with a 401(k) had only $111,000 in combined 401(k) and IRA balances, which translates into less than $400 per month adjusted for inflation.” – Alicia H. Munnell, Director, Center for Retirement Research

- On average, couples who retire at 65 need $260,000 in retirement savings for healthcare costs alone.

For marketers focused on 50+ consumers, consider:

- How will sales of your product or service be affected by the economic fragility of many retirees?

- Does your messaging reassure older adults that you are stable, even when public supports may not be? Or that you are a sound partner, helping them manage finances or health now, at the same time you are helping them prepare for the future?

- Are you being transparent with your pricing so that seniors can qualify / disqualify themselves early in their decision-making journey?

As James Johnson of the Urban Investment Strategies Center and Allan Parnell of the Institute for Sustainable Communities write, “It must be recognized that most older adults are not obsessing over arthritis, incontinence, or dementia.”

What they likely ARE obsessing over is how to pay for it all.

We’ll be sharing more outtakes and action items from this comprehensive report over the coming weeks via Twitter and this blog. Download / read the issue at http://bit.ly/2jUtFIX.

JUST FOR FUN

Tweet out stats showing that GenX spends the most time on social media and it’s guaranteed a GenXer will use social media to respond:

Brian might be right, but we’ll call it a side-effect of his job. He’s part of the highly-social, highly-talented marketing team at Ben & Jerry’s. Our appreciation for the organization’s social media talents goes back to at least 2013 …

but appreciation for the gooey goodness that they bring to my belly is timeless.

Just a little palate-cleanser after all the wonderful wonky policy details. Now, back to the round-up!

MOST SHARED: Skilled Trades Sounding Alarms about Baby Boomer Retirement

As noted above, aging services leaders are urging the new administration to enact policies that will make it possible for older adults to remain active workers for longer.

Skilled trades industries — accounting, finance, education and more — share the same goal.

As Gloria Dunn-Violin reports for the North Bay Business Journal, this is a slow-motion crisis that is already starting to have an impact. As Boomers retire, companies are having a hard time finding replacement workers for these skilled positions.

In Massachusetts, for example, “The Boston Globe reports that by 2018 employment growth in Massachusetts is expected to plunge by more than half—not because there aren’t jobs, but because there won’t be enough workers to fill them.”

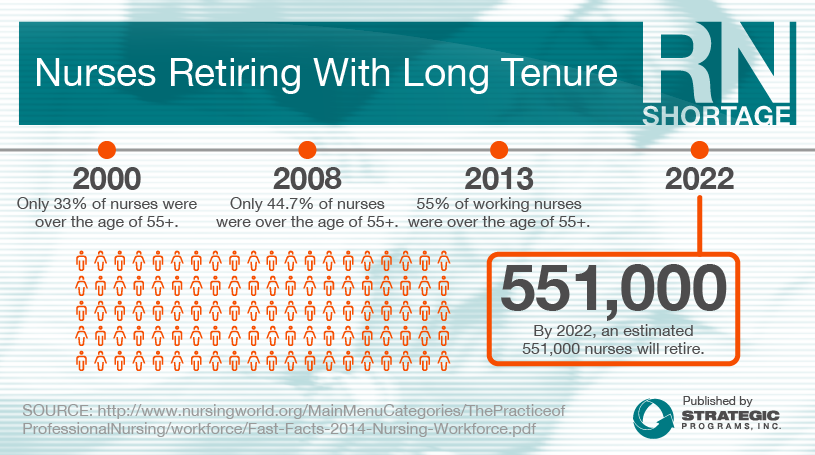

And nationwide, by 2020, an estimated 80,000 registered nurses will retire a year, up from 30,000 a decade ago.

For 50+ marketing pros, consider: Will the “boom” in retirements by baby boomers have an impact on your business and your ability to serve older adults? How could your communications team help in recruiting or developing new skilled workers, and/or facilitating knowledge transfer?

Read the article: http://bit.ly/2jUd0Ku

Please let us know if we’ve made your Monday a little brighter — or how we could do so in future posts — by posting a comment below.