A day late, but not a dollar short, this week’s links reveal a need to be nimble. All industries must adjust to the changing and growing needs and expectations of an aging population.

We look at both ends of the financial spectrum here — from those who can afford to look for, and demand, options to fit their busy lifestyles, to those who are simply trying to survive without a pension or retirement funds.

MOST CLICKED: In the senior housing market, builders are increasingly looking at the preferences of the younger buyer.

Amanda Kolson Hurley, writing in CityLab, looks at how Del Webb, the country’s largest builder of active-adult housing, has been adjusting its designs and adding new features to appeal to the nation’s 76 million Baby Boomers.

According to Del Webb spokesperson Jacque Petroulakis, the company is focusing on these top preferences:

- A work-friendly lifestyle—79 percent anticipate continuing to work in some capacity after they retire (per 2013 Del Webb survey of Boomers)

- Personal fitness—which has overtaken golf and tennis amenities as the #1 recreational choice for Boomers

- Outdoor activities—when asked what the most important amenities are, seniors more frequently identify walking, hiking and biking

Del Webb is seeing an increasing amount of single buyers, but single and partnered buyers alike are not downsizing as much as they used to. They prioritize having space for visiting friends and family, Petroulakis says. And they often want to keep the personal objects they’ve collected over a lifetime, not cull them, so storage “is a huge concern.”

Read More: http://bit.ly/1ogpucH

MOST SHARED: In stark contrast to the housing-savvy Boomers discussed above, the plight of those not able to take advantage of the many 55+ lifestyle choices interested Creating Results’ social followers.

A recent pictorial Los Angeles Times piece looked at the large population of citizens who are “Too Poor to Retire and Too Young to Die.” In this moving report by John M. Glionna with photos by Francine Orr we see the realty of those who cannot afford not to work as they reach their elder years.

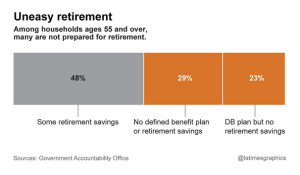

Stories include a profile of Dolores Westfall. At age 79, Westfall is among the nearly one-third of U.S. heads of households ages 55 and older with no pension or retirement savings and a median annual income of about $19,000, as shown in the chart.

Stories include a profile of Dolores Westfall. At age 79, Westfall is among the nearly one-third of U.S. heads of households ages 55 and older with no pension or retirement savings and a median annual income of about $19,000, as shown in the chart.

Read about Westfall and other moving stories about this group: bit.ly/1Q8F4yk

ALSO OF NOTE: The Huffington Post offers us “15 Reasons that Motivate You to WANT to Grow Old.” Happily, eating chocolate, travel and sleep are top on this list. See for yourself which of these pursuits will make aging better for you: bit.ly/1T49d8h. And please share your own motivations below!