Happy Monday!

Today’s mature marketing news of interest is brought to you by the letter “S”. Each week we share stories or action items that are important to know for those targeting mature consumers. Have something to share? We’d love to hear your comments and ideas (and we promise to respond accordingly).

MOST SHARED: If you’ve read anything regarding social media adaptation you’ll know that it’s growing…quickly. And not just Facebook usage, but all social media platforms. How we leverage social media is also adapting, and according to a recent study conducted by Pew Research, 62% of all adults get the majority of their news from social media platforms.

MOST SHARED: If you’ve read anything regarding social media adaptation you’ll know that it’s growing…quickly. And not just Facebook usage, but all social media platforms. How we leverage social media is also adapting, and according to a recent study conducted by Pew Research, 62% of all adults get the majority of their news from social media platforms.

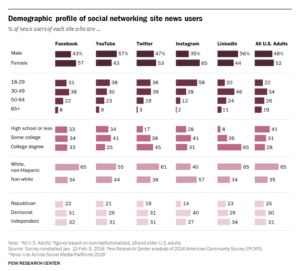

Pew examined usage across 9 key social platforms. The findings:

- 2/3 of adults get news from Facebook

- YouTube, while having large reach, doesn’t serve as a news source with only 1/5 users obtaining from this channel

- 64% of adults rely on 1 primary social channel for their news source

- People who gather news from YouTube. Facebook and Instagram are exposed more as a part of their general usage and not because they are seeking news out specifically

- Those platforms where users ARE seeking news tend to be Reddit, Twitter and LinkedIn

- For those 55+ ers seeking news on social platforms: YouTube is the most used for 55-64 and LinkedIn for those 65+

For those targeting mature consumers, knowing is certainly half the battle. But it’s not just knowing WHERE your target market is socially, it’s knowing WHAT they value most. Make sure this knowledge is reflected in your content and plan for how you leverage social as a part of your integrated marketing strategy, and be on the lookout for our newest Social, Silver Surfers research to gain even more actionable insights as they pertain to all things web and social for boomers and beyond.

MOST CLICKED: One of the wonderful, personal benefits to working within the senior living space (one of the many) is that I’ve learned a great deal of tips for how best to prepare for my own retirement. A recent article reinforced that need, noting that Boomers in general need to be doing a better job of ensuring they have adequately prepared for their retirement.

Across the U.S., people who are age 65 years and older are facing a median income of only 60% of what pre-retirees — those 45 to 64 years old — are making, according to the study based on the U.S. Census Bureau’s 2014 American Community Survey.

“These numbers illustrate that many Americans are underprepared for retirement,” said Greg McBride, CFA, Bankrate’s chief financial analyst. “In addition to saving more, people should consider working longer because for each additional year that you work, your assets have more time to grow. It is also an opportunity of another year for you to save and one less year the money has to support you in retirement.”

According to a survey noted within the article, boomers living within 15 states are experiencing the largest gap when it comes to what they have saved and what they will need. The author shared a number of things that everyone should be doing to make sure they are as prepared as possible to not only retire well, but enjoy that chapter of life.

- Maximize your 401K contributions

- Pay off all debt

- Hold on drawing on your social security if possible (even waiting until you are 70 can make a HUGE difference)

- Look to your taxes to see how you can save each year

- Make lifestyle adjustments NOW so the shock is minimized when the time comes to retire and you have to scale back on expenses