Every week, we take a look at the content that engaged our followers the most from the previous week.

This week, the New York Times gave an in-depth look at the increasing popularity of “brain gyms” in retirement communities.

Also, a study by The Associated Press-NORC Center for Public Affairs Research shows that there is still a long way to go in regards to instilling confidence in adults 40+ as they finance their long-term care plans.

MOST CLICKED: Earlier this month The New York Times discussed the impact that keeping an active brain can have on retirees’ overall health. Retirement communities across the country are starting to implement “brain fitness” classes to help Boomers and seniors stay mentally strong.

Today’s baby boomers are encouraged more than ever to break a sweat… but not only in the way one would expect. Researchers and experts agree that initiatives that support brain exercise are of the utmost importance to aging well.

Paul Nussbaum, President of Brain Health Center in Pittsburgh, explains that your brain is unaware of its age and always wants to learn.

Our brains need to rely on novelty and complexity and numerous types of focused activities will keep the brain engaged. Nussbaum argues that, paired with exercise and nutrition, a more resilient brain will result from social, mental and spiritual engagement.

While many senior living communities have invested in state-of-the-art physical fitness centers, not as many have paid as much attention to mental fitness. Take advantage of the new technology that has been developed to ensure that your community’s members are continuing to be mentally stimulated, even as they continue to age.

While many senior living communities have invested in state-of-the-art physical fitness centers, not as many have paid as much attention to mental fitness. Take advantage of the new technology that has been developed to ensure that your community’s members are continuing to be mentally stimulated, even as they continue to age.

Investing in a “brain gym” is a way to set your community apart from other communities by making mental health a priority rather than an afterthought.

Programs such as brain gyms need to be emphasized when setting your community apart from other communities. Spotlight brain fitness in marketing materials including your website and newsletters, as North Hill does.

Family members will feel a lot more confident knowing that the community is investing resources into keeping their loved ones mentally stimulated and engaged.

Click here to read more about the importance of “brain fitness” for older adults.

MOST SHARED:

Results from the 2016 Long-Term Care trends poll conducted by The Associated Press-NORC Center for Public Affairs Research suggest that Americans age 40 and over are slowly, but surely, growing more confident in their ability to finance their long-term care needs.

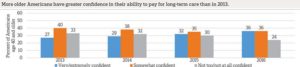

However, the poll numbers show that, despite the increase, confidence is lower than it should be, as evidenced by the graphic below. As you can see, only 36 percent of Americans 40 and older claim to be “very/extremely confident” in their ability to pay for long-term care in 2016. Though this is a 9 percent increase from 2013, it is still a lot lower than it should be, especially considering the projected increase of the senior population in the coming years.

As you can see, only 36 percent of Americans 40 and older claim to be “very/extremely confident” in their ability to pay for long-term care in 2016. Though this is a 9 percent increase from 2013, it is still a lot lower than it should be, especially considering the projected increase of the senior population in the coming years.

There a few takeaways from the poll that those in the senior living industry should be aware of as they market their products and services to the ever-growing senior population.

First, nearly 4 in 10 Americans are expecting to rely on Medicare and social security to finance their long-term care. Unfortunately, neither of these programs cover the full cost of long-term care.

It’s important for senior living communities to begin educating the coming generation of seniors on the financial aspects of long-term care so that, when they time comes, they have saved enough money to be able to pay for the care that they will eventually need.

While many senior communities have financial programs in place to help prospective residents protect their financial assets and plan for future costs, it is important for this to become a staple in all communities as the demand for long-term care increases.

If your community already has these types of programs in place, this should be leveraged as a unique selling point to differentiate your community from the competition.

Even something as simple as including a retirement living cost calculator on your community’s website (as client Sun Health Senior Living does) can set you apart from other communities.

Cost calculators give prospective residents a rough estimate of just how much they will be spending should they move to a CCRC, yet most communities neglect to include this feature on their websites, leaving would-be residents to do all the guesswork when it comes to financing their retirement.

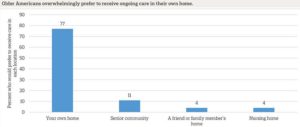

Another important takeaway is that 77 percent of the people who participated in the poll stated that they would prefer to receive care for themselves in their own home. It is evident that aging at home is the most popular option with the new generation of senior living.

Does your community offer any senior living at home services? It is becoming more common for senior living communities to offer services such as care coordination, medical support, memory care and enrichment opportunities for people who would prefer to age in their own homes.

Although the person may not be a physical resident in the community, they are able to take advantage of many of the benefits and opportunities that community members receive. In essence, the person can age in place knowing that their care needs are being managed by your community, which is, of course, being compensated financially for this care management.

They’re another point of marketing differentiation, as well. Despite the challenges illustrated in the Long-Term Care poll, all sides could come out as winners.

Click here to read the remaining takeaways from the Long-Term Care Poll.