It’s time for us to once again recap the most engaging content from the previous week.

This week, Senior Housing News proposes a rebrand of 55-plus senior living communities in order to attract younger prospects to age-restricted housing. Also, research into Baby Boomer banking habits provides insights into marketing senior products and services to this demographic.

Most Clicked: It’s Time to Rebrand 55-Plus “Senior Living”

In this week’s most clicked content, Dan Huston, Chief Strategy Officer at Cornerstone Affiliates, suggests a rebrand of the 55-plus senior living concept, as reported by Senior Housing News.

One thing many marketers are quick to admit is that, in this industry, there is regularly a difference between what’s ideal and what’s real.

“55-plus is really 55-plus-plus-plus,” Hutson explains. “I’m 56, and there is no way I would ever live in a community that labels itself, in any way, as senior living.”

Before continuing, it is important to establish the difference between 55+ age-restricted rental communities and senior living communities. In age-restricted rental communities, at least one renter in every apartment must be at least 55 years old and the community must have no more than 20% of all renters under the age of 55, Seniorsource.com explains.

On the other hand, senior living communities are made up entirely of older adults and offer more than just housing. These offerings include a continuum of care, support services, community programs and more.

One thing we’ve observed is that marketers in the senior living industry sometimes fail to take into account is the life stage of someone who is 55-plus in 2017. More often than not, members of this demographic are still working full-time jobs and possibly still have teenagers at home.

As such, they are likely not at a point in their lives where they are ready to experience the benefits of the senior lifestyle in your community. Simply put, they don’t see themselves as seniors just yet and probably won’t for another 10 or 15 years.

That is why, despite the ideal images we have of independent living communities filled with lively 55- and 60-year-olds, the reality is that the average age of a new resident is between 70 and 73, according to Dale Boyles, Managing Director at Alliance Residential Company.

This doesn’t mean that there aren’t opportunities for 55-plus communities, concludes Hutson. It means we have to rethink the ways we market these communities to our ideal prospects.

As Huston suggests, the first order of business is to remove the “senior living’ tag from 55-plus living. Many people are likely to disqualify themselves from any community promoting its “independent, 55-plus senior lifestyle” due to the traditional image of senior living that they have in their heads.

We also have to take into account the reasons a 55-year-old would opt for an age-restricted rental community. Per Boyles, these reasons include:

- Affordability: for those who may not have the means for more luxurious options, more basic rental options range from $800-$1200 per month.

- Convenient location: homeowners will likely want to be next to shopping, restaurants and other attractions.

- Lifestyle: opportunities to continue working and to live among people who are in a similar age bracket and share similar interests.

It’s important to remember that the decision to move to an age-restricted community isn’t needs-based; it’s one that is rooted in lifestyle. People interested in this type of lifestyle aren’t looking for assistance with daily activities. A good example is the print ad Creating Results designed for a 55+ rental community, Verena at the Reserve. It leads with lifestyle.

Boomers are looking for a place where they can continue to enjoy the lifestyle they’ve become accustomed to without the hassles they faced in their 30s and 40s, such as constant home maintenance. This is what the Creating Results team believes you we should be emphasizing when marketing these communities to prospective 55-plus homebuyers.

Click here to read the entire article on rebranding 55-plus senior living.

Most Shared: New Infographic Provides Baby Boomer Marketing Insights

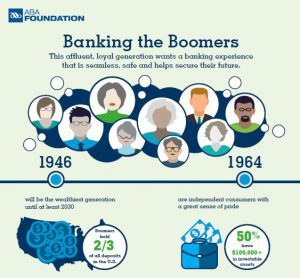

In this week’s most clicked item, a newly released infographic from the American Banking Association (ABA) provides insights into Boomer banking habits that can also be applied by marketers in the senior product/services industry.

One such insight is that 71% of Baby Boomers use online banking services at least once a week. Contrary to stereotypes, not only is this demographic using technology such as tablets, smartphones and laptops, they are becoming more savvy with these devices.

As Boomers continue to use these devices for daily tasks, we will continue to express the importance of investing resources into digital marketing. You must provide a seamless desktop and mobile browsing experiences for prospects visiting your website.

Additional best practices and insights on digital marketing to Baby Boomers and Seniors can be found in Social, Silver Surfers.

(Senior living marketers, download our white paper to learn more.)

(Senior living marketers, download our white paper to learn more.)

Another takeaway from the ABA infographic is that, while Baby Boomers are expected to be the wealthiest generation until at least 2030, only 24% of them are confident that they’ll have enough money to last through retirement. It is believed that many Boomers have underestimated the cost of post-retirement healthcare by 10%.

If you are marketing a continuing care retirement community (CCRC), do you have programs in place to assist residents as they try to get a clearer picture of their financial and healthcare cost needs in the future? It is one thing to offer them all the features and amenities they could ever want. It is another thing to go the extra mile to help them feel confident they will be able to afford these services for the duration of their retirement.

Guidance on wealth management or on service options as needs change is a way that your community can set itself a part from competitors. Prospective residents will come to see you as a valuable resource for their retirement planning.

Click here to see the entire “Banking the Boomers” infographic.